Inox Wind | Quick Take

August 20, 2018

INOX Wind

BUY

CMP

`101

TAILWIND ahead

Target Price

`130

Inox Wind is India’s leading wind energy solutions provider servicing IPPs, Utilities, PSUs,

Corporates and Retail Investors. Inox Wind is a fully integrated player in the wind energy

Investment Period

12 Months

market with three state-of-the-art manufacturing plants in Gujarat, Himachal Pradesh

and Madhya Pradesh with a cumulative manufacturing capacity of 1,600MW.

Stock Info

Significant revenue improvement: Wind energy sector has seen tectonic

Sector

Capital goods-Wind Turbine

transformation in FY2018 due to changes in Auction regime from FIT regime to Reverse

Market Cap (` cr)

2,251

auction regime, which removes counterparty risks and default in payments. Owing to

reduction in uncertainty like PPA (Power Purchase Agreement) and connectivity, we

Beta

0.9

expect participation in bidding to increase along with the increasing effort of GoI for

52 Week High / Low

158.4/75

auctioning of 10GW wind energy every year till 2028. This would create strong revenue

Avg. Daily Volume

55,482

visibility for wind turbine manufactures like Inox Wind going forward. We expect Inox

Face Value (`)

10

Wind to report `3,360cr and `3,971cr revenue in FY2019E and FY2020E respectively

BSE Sensex

37,974

owing to majority of executions from SECI-I and SECI-II orders.

Nifty

11,470

Strong order book: Inox Wind bagged orders from all the central wind power auctions

Reuters Code

INOX.BO

conducted by the Solar Energy Corporation of India (SECI) during FY2018 under the

Bloomberg Code

auction regime. It also bagged 50 MW in the Maharashtra State auction, which has

INOX IN

enhanced its auction based order book to a sector leading candidate with 950 MW in

the Indian wind power industry. This provides Inox Wind with strong execution visibility

Shareholding Pattern (%)

over the next 12-18 months.

Promoters

75.0

Outlook & Valuation: We expect Inox Wind to report exponential growth in top-line

MF / Banks / Indian Fls

0.4

and bottom-line over FY2019-20E. The growth would be led by changing renewable

FII / NRIs / OCBs

7.8

energy industry dynamics in favor of wind energy segment viz. changes in auction

regime from Feed-In-Tariff (FIT) to reverse auction regime and Government’s guidance

Indian Public / Others

16.8

for increasing wind energy capacity from 34GW currently to 140GW by 2030. We believe

INOX Wind is in a sweet spot to tap the upcoming opportunity in renewable energy

Abs.(%)

3m

1yr

3yr

segments. At the CMP of `101, Inox Wind is trading at 6x FY2020E EPS of `17.4.

Sensex

8.0

19.4

35.2

Considering the above positives, we recommend BUY on Inox Wind and assign a

multiple of 7.5x on FY2020EPS to arrive at a Target Price of `130 (potential upside of

INOXWI

3.8

(8.8)

(74.6)

29% over a period of next 12-18 months).

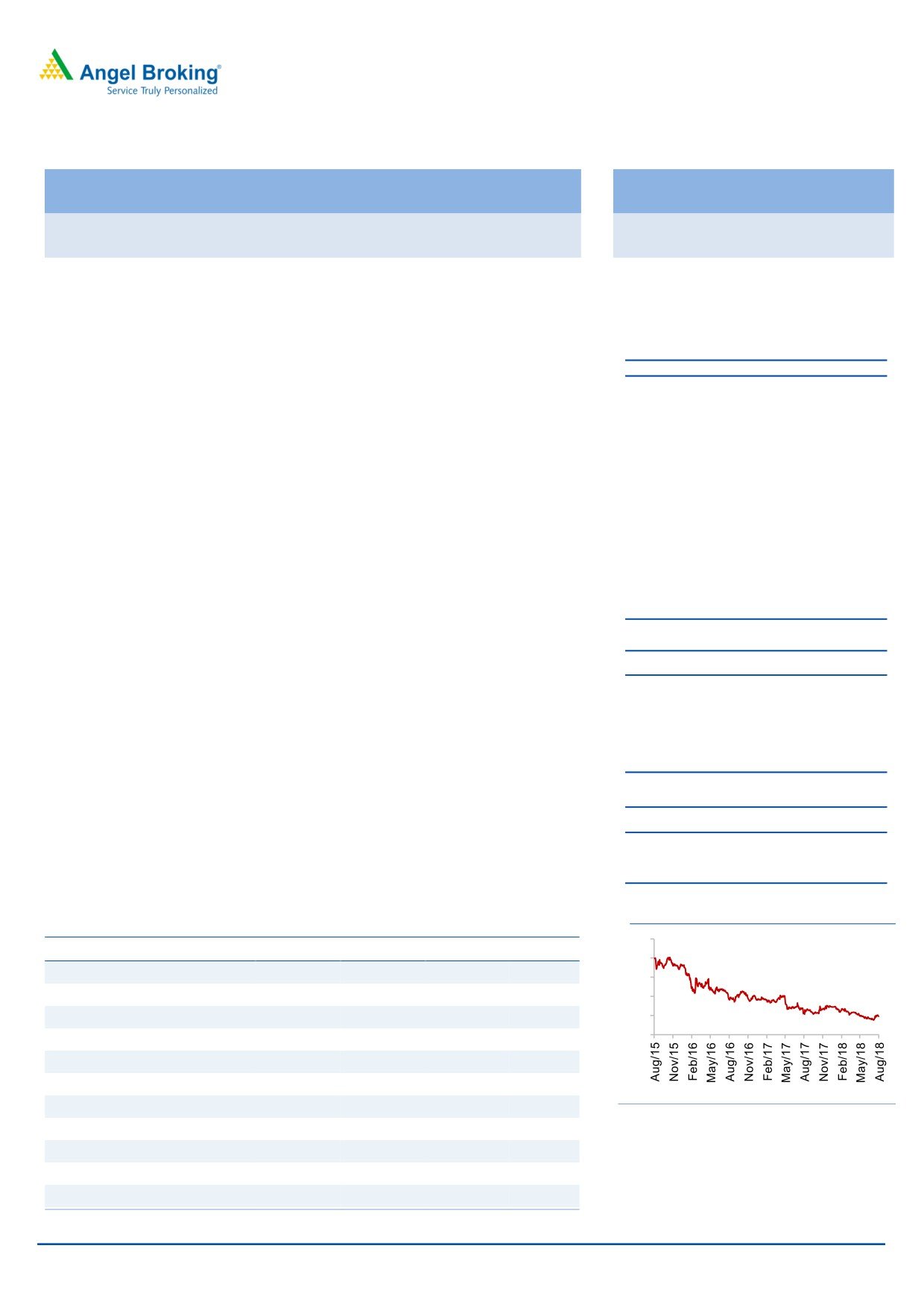

3 Years price performance

Key Financials

500

Y/E March (` cr)

FY16

FY17

FY18

FY19E

FY20E

400

Net Sales

4,451

3,415

480

3,360

3,971

300

% chg

65

(23)

(86)

600

18

200

Net Profit

461

303

(188)

273

385

100

0

% chg

(30)

(34)

(162)

(246)

41

EBITDA (%)

16.0%

16.4%

-17.0%

14.3%

15.3%

EPS (Rs)

21

14

(8)

12

17

P/E (x)

5

8

(12)

8

5.9

Source: C-line, Angel Research

P/BV (x)

1.2

1.0

1.1

1.0

0.9

RoE (%)

24.4

13.9

(9.4)

12.0

14.5

RoCE (%)

20.4

13.9

(4.7)

13.7

15.7

Kripashankar Maurya

022 39357600, Extn: 6004

EV/EBITDA

4.2

5.5

(32.2)

5.8

4.0

Source: Company, Angel Research; Note: CMP as of August 17, 2018

August 20, 2018

1

Inox Wind | Quick Take

Company background

Inox Wind is India’s leading wind energy solutions provider servicing IPPs,

Utilities, PSUs, Corporates and Retail Investors. Inox Wind is a fully integrated

player in the wind energy market with three state-of-the-art manufacturing plants

in Gujarat, Himachal Pradesh and Madhya Pradesh with a cumulative

manufacturing capacity of 1,600MW.

Inox Wind manufactures three variants of the 2 MW WTG:

Rotor diameter of 93 meters with hub height of 80 meters

Rotor Diameter of 100 meters with hub height of 80 / 92 meters

Rotor Diameter of 113 meters with hub height of 92 meters

Rotor Diameter of 113 meters with hub height of 120 meters

Inox Wind owns a 100% subsidiary, Inox Wind Infrastructure Services, which does

the project development in respect of wind power projects, including wind

studies, energy assessments, land acquisition, site infrastructure development,

power evacuation, statutory approvals, erection and commissioning and long

term operation and maintenance of the wind farms.

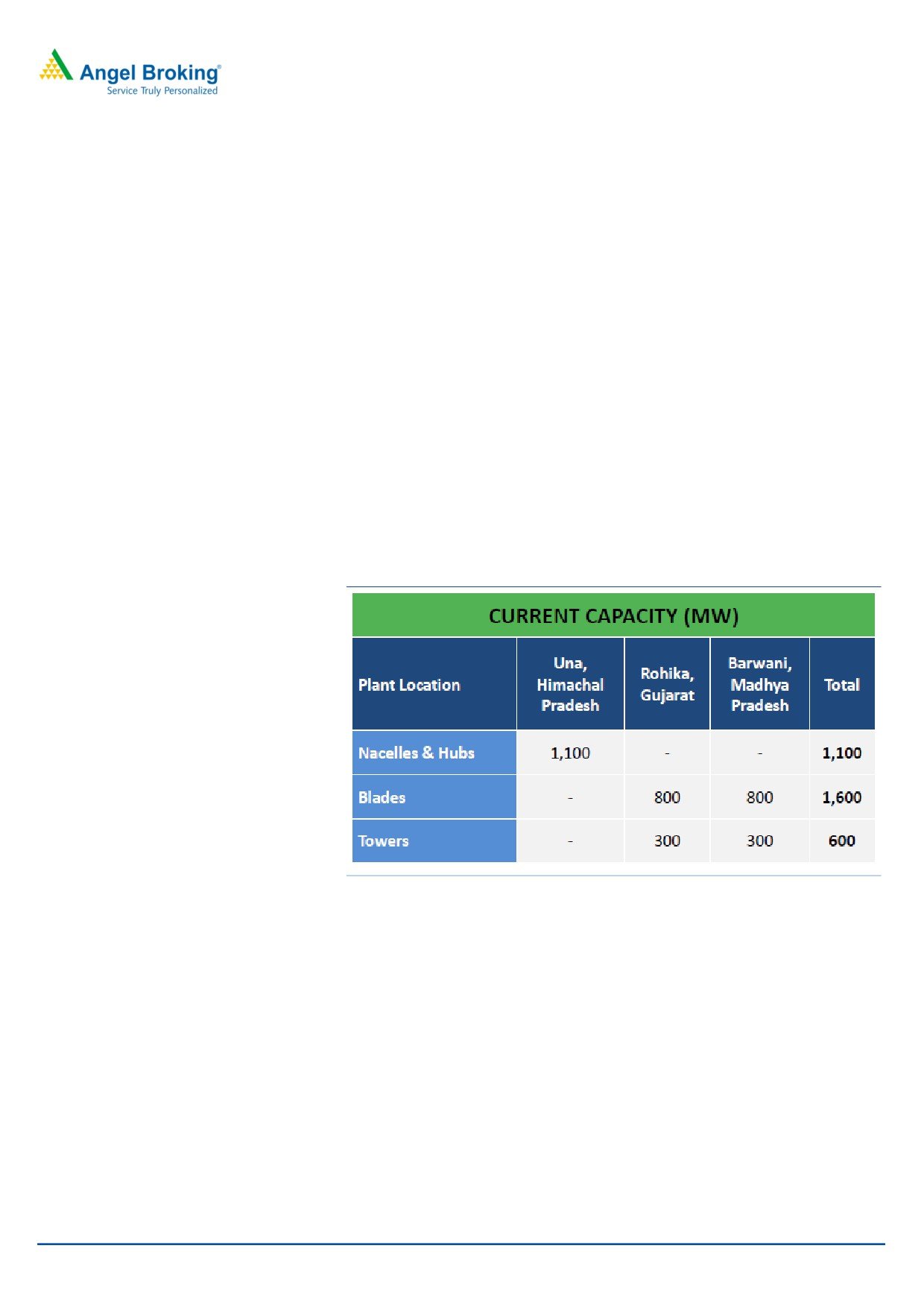

Exhibit 1: Installed capacity

Source: Company, Angel Research

Sector outlook

Overview of renewable energy sector in India

Renewable energy capacity in India has grown at a CAGR of 24% over FY2012-18.

The installed renewable energy generation capacity in India was 69GW as of

March 2018, which represented 20% of the total installed generation base in

India.

However, total electricity generated from the installed renewable energy

capacities (or renewable energy penetration in the grid) still remains low at

approximately 7%, with wind energy garnering maximum share of 4% of the total

energy supplied in the country as on February 2018. There is a significant amount

of potential for renewable energy capacity installations in India.

August 20, 2018

2

Inox Wind | Quick Take

Exhibit 2: Renewable energy Potential

Technology

Potential GW

Cumulative Capacity as of March 18 GW

Wind

302

34.04

Solar ground mounted

749

20.59

Solar Rooftop*#

210

1.06

Biomass+bagasse cogeneration

22.5

8.7

Samll Hydro (upto 25MW)

19.5

4.49

Waste to Energy

NA

0.14

Source: Renew Power Limited (DRHP), Angel Research

*The economically feasible market potential for rooftop solar PV in urban settlements of

India; excludes offgrid/ captive solar capacities

#Excludes estimates of ~1.0 GW of roof top capacities which is not subsidised by the

MNRE

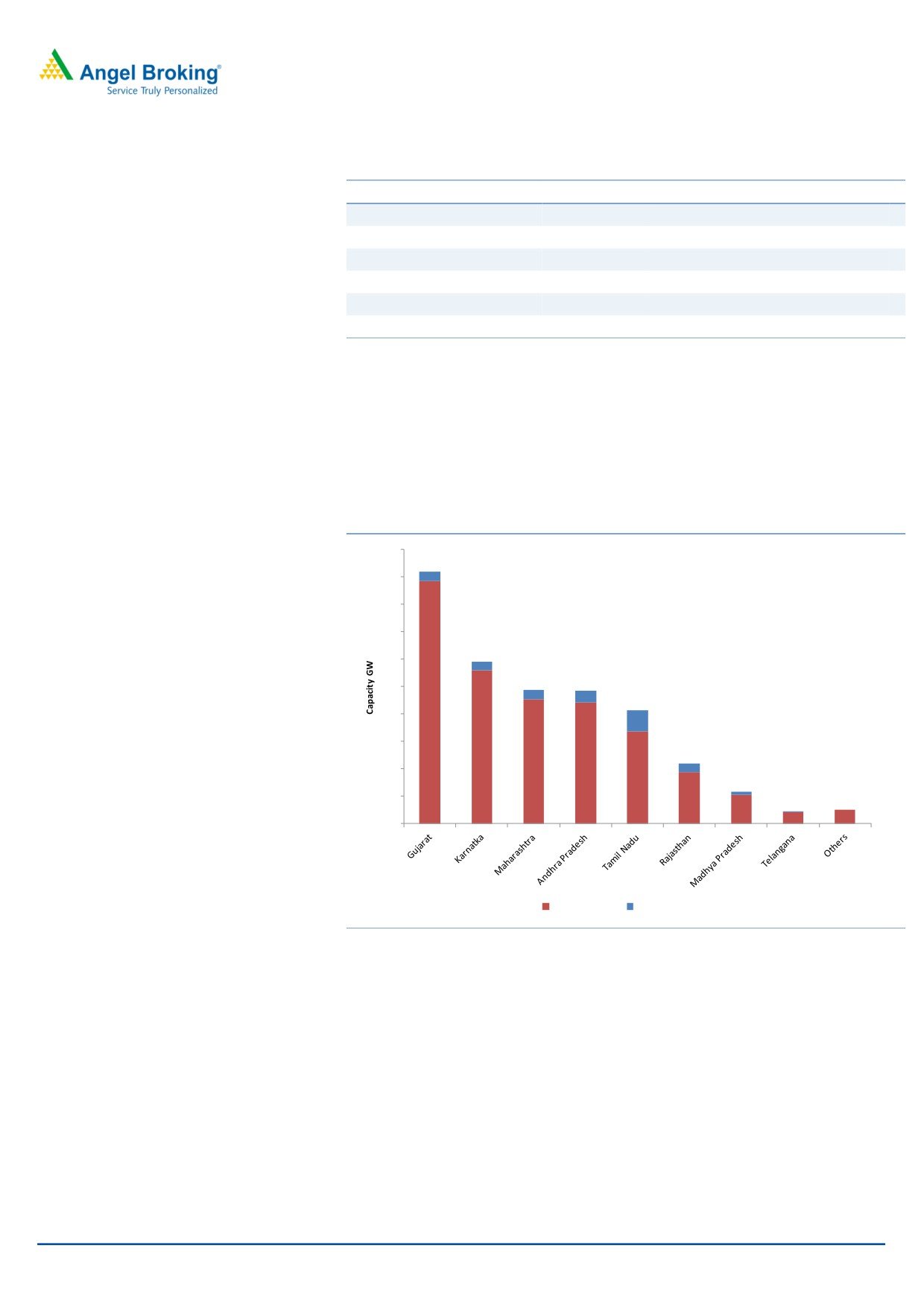

Exhibit 3: State wise estimated potential

100

90

3.4

80

70

60

3.3

50

3.5

4.5

88.4

40

7.5

30

55.9

45.4

44.2

20

3.1

33.8

10

18.8

1.1

10.5

0.0

0.0

4.2

5

0

Potential (GW)

Achived (GW)

Source: Company, Angel Research

Expected improvement in RPO compliance

Going forward, there is likely to be pressure on state discoms to improve RPO

(Renewable Purchase Obligation) compliance to support demand for wind energy.

In fact, under its revised guidelines on the RPO obligations (released in June

2018), the government has proposed a sharp ramp up in total non-solar-based

RPOs to 10.5% by FY22 from 8.75% in FY17, which will drive the demand for

cheaper wind power.

August 20, 2018

3

Inox Wind | Quick Take

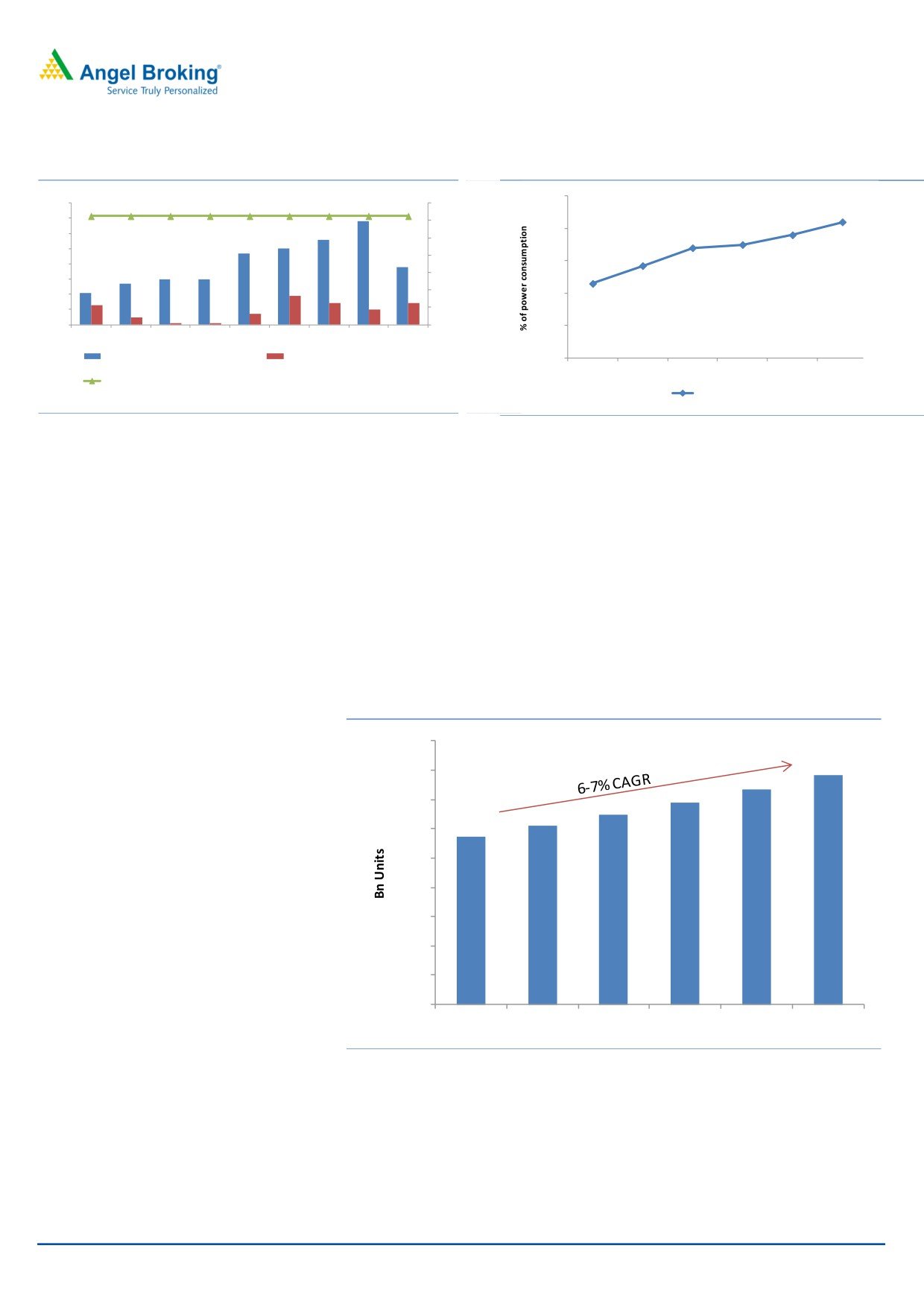

Exhibit 4: Current RPO and compliance

Exhibit 5: RPO target

25.0%

8.0%

14.0%

6.8%

21.0%

7.0%

12.0%

19.0%

5.6%

20.0%

17.5%

6.0%

17.0%

5.0%

10.0%

4.7%

5.0%

14.3%

3.8%

8.0%

4.0%

15.0%

3.0%

3.0%

11.5%

6.0%

2.7%

3.0%

2.1%

1.9%

4.0%

2.0%

1.3%

1.4%

1.4%

10.0%

1.0%

1.0%

0.5%

0.7%

2.0%

0.1%

0.1%

0.0%

0.0%

5.0%

Chattisgarh Orissa

Delhi

Jharkhand Haryana

Uttar

Madhya Assam

Bihar

Pradesh Pradesh

Non Solar RPO Target (2016)

Non Solar RPO Compliance (2016)

0.0%

FY17

FY18

FY19

FY20

FY21

FY22

MoP Target for Non-Solar RPO (FY2019)

RPO

Source: CRISIL, Angel Research

Source: MoP (14th June 2018), Angel Research

Power demand to grow at 6-6.5% CAGR over FY2019-22

Power demand is expected to register a healthy growth CAGR of 6-6.5% over the

next 5 years i.e. FY2018-22. Industrial demand is expected to grow at a moderate

pace, in-line with GDP growth and gradual pick-up in economic activity. However,

residential demand is expected to witness stronger growth on account of higher

latent demand and rapid urbanization coupled with impetus from government for

rural electrification. Electricity consumption in domestic segment is estimated to

increase at a rapid pace of around 8.5-9% over FY2018-22 and its share in total

electricity consumption is expected to increase to 25% in FY2021 from 23% in

FY2016.

Exhibit 6: Power demand

1800

1566

1600

1400

1143

1200

1000

800

600

400

200

0

FY17P

FY18P

FY19P

FY20P

FY21P

FY22P

Source: CRISIL, Angel Research

Shift from feed-in-tariff regime to auction based tariff regime

The Wind Power industry witnessed a major transition or disruption in FY2018

owing to the migration from a feed-in-tariff (FIT) regime with regulated state

announced tariffs to a reverse auction-based addition of wind capacity, which

encourages competitive bidding and better price discovery. The auction-based

August 20, 2018

4

Inox Wind | Quick Take

regime has led to reduction of power tariffs for the discoms and brought in

greater transparency into the marketplace. It is also expected to expand the wind

turbine market considerably to a 10 GW per annum market compared to a 3-4GW

per annum market historically.

The main advantages of an auction based market include:

• Increased market size

•Reduced regulatory risks for power producers by ensuring upfront signing of

Power Purchase Agreements

•Evacuation of power produced through the central grid ensuring

99%+

availability of the grid

•Increased payment security, given payment from central government bodies

rather than state discoms

Exhibit 7: Reverse auction benefits

Source: Company, Angel Research

Key Investment Argument

Leadership across wind rich states

Inox Wind is the largest project site allottees in Gujarat, Rajasthan and Madhya

Pradesh. It has also expanded presence in Andhra Pradesh, Karnataka and Kerala.

Company owns sufficient project site inventory for the installation of an

aggregate capacity of over 5,000MW.

Strong order book

Inox Wind bagged orders from all the central wind power auctions conducted by

the Solar Energy Corporation of India (SECI) during FY2018 under the auction

regime. It also bagged 50MW in the Maharashtra State auction, which has

enhanced its auction-based order book to a sector-leading 950MW in the Indian

wind power industry. This provides Inox Wind with strong visibility of execution

over the next 12-18 months.

Extending product offering

Inox Wind is working on a 3MW wind turbine suited for the Indian conditions. The

3MW turbine will eventually extend product offerings in India and reinforce Inox

August 20, 2018

5

Inox Wind | Quick Take

Wind’s position as the leading wind turbine manufacturer across the nation. The

development of the 3MW turbines reiterates firm commitment to provide the

clients with superior, energy efficient, resource saving technologies. It will ensure

that Inox Wind continues to play a pioneering role in India’s wind turbine

industry.

Increasing O&M credibility and capabilities going forward

We expect O&M revenue to improve significantly as installed capacity of wind

turbine is increasing every year. Currently, Inox Wind has 2.4GW of wind turbine

installed capacity with multiyear O&M agreements with ~5% escalation clause. A

large part of this fleet has already gone off their two-year warranty period, and

hence the O&M revenues in terms of cash flows would have started flowing in.

Further, O&M revenues are noncyclical in nature. They have steady cash flow

generation and have significantly higher margins than average company margins

and hence would help in the company’s margin profile as well.

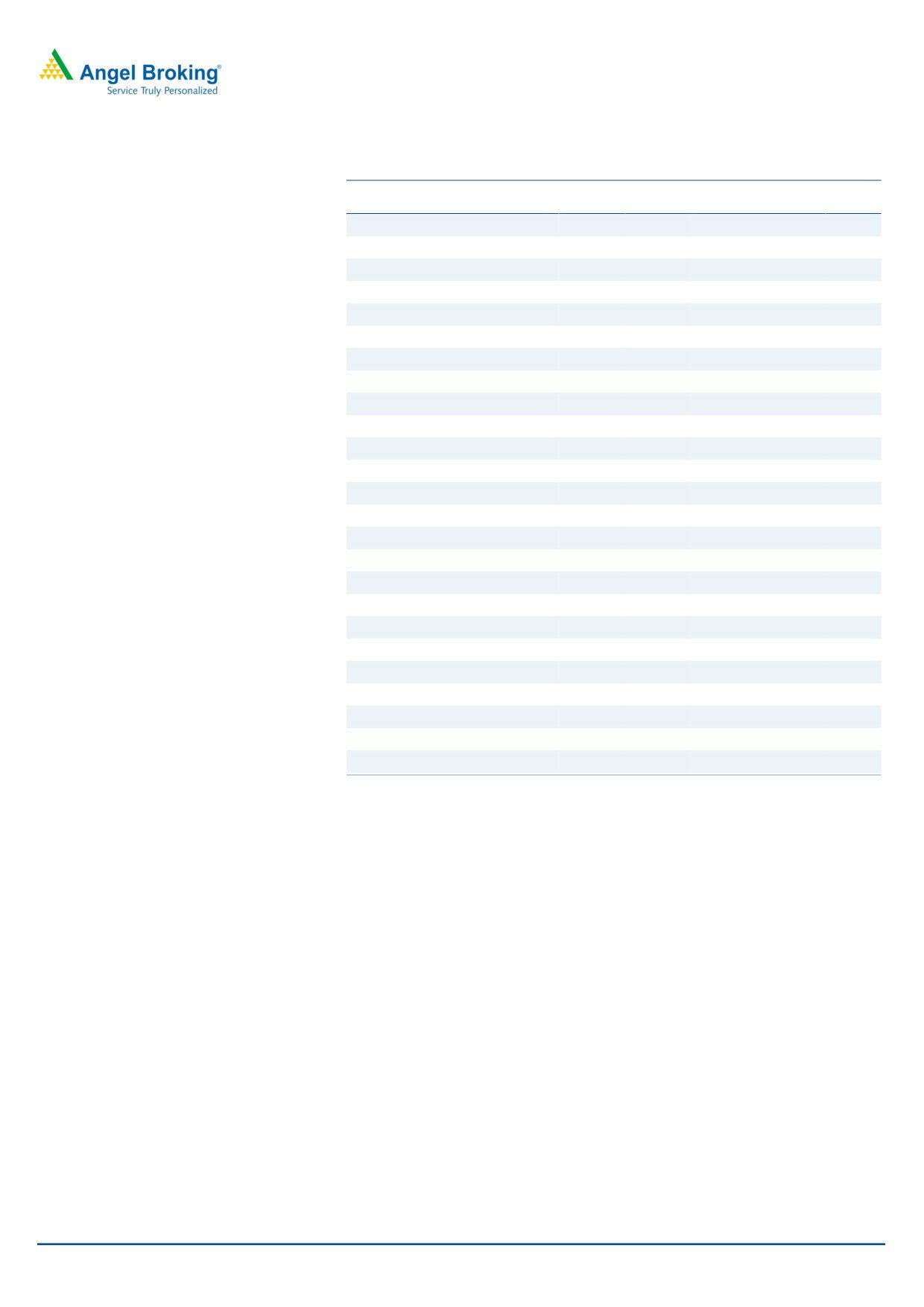

Revenue expected to improve significantly

Wind energy sector has seen tectonic transformation in FY18 due to changes in

Auction regime from FIT regime to Reverse auction regime. This removes

counterparty risks and default in payments. Owing to reduction in uncertainty like

PPA and connectivity, we expect participation in bidding to increase along with

increasing effort of GoI for auctioning of 10GW wind energy every year till 2028,

which creates strong revenue visibility for wind turbine manufactures like Inox

Wind going forward. We expect Inox Wind to report `3,360cr and `3,971cr

revenue in FY19E and FY20E respectively owing to majority of execution from

SECI-I and SECI-II orders.

Exhibit 8: Revenue trend

5000

20%

16%

16%

15%

15%

14%

4000

10%

3000

5%

2000

0%

-5%

1000

-10%

0

-15%

FY16

FY17

FY18

FY19E

FY20E

-17%

-1000

-20%

Net Sales

Net Profit

EBITDA

Source: Company, Angel Research

August 20, 2018

6

Inox Wind | Quick Take

Outlook & Valuation: We expect Inox Wind to report exponential growth in top-

line and bottom-line over FY2019-20E. The growth would be led by changing

renewable energy industry dynamics in favor of wind energy segment viz.

changes in auction regime from Feed-In-Tariff (FIT) to Reverse auction regime and

Government’s guidance for increasing wind energy capacity from 34GW currently

to 140GW by 2030. We believe INOX Wind is in a sweet spot to tap the upcoming

opportunity in renewable energy segments. At the CMP of `101, Inox Wind is

trading at 6x FY2020E EPS of

`17.4. Considering the above positives, we

recommend BUY on Inox Wind and assign a multiple of 7.5x on FY2020EPS to

arrive at a Target Price of `130 (potential upside of 29% over a period of next 12-

15 months).

Risk and Concern

Delay in auction

Any delay in auction of wind energy may leads to slowdown in sector hence

create an uncertainty in revenue visibility.

Lower bidding

Due to introduction of reverse auction bidding which reduces the uncertainty with

respect to PPA and connective issues, encourages the participation of Investor

which may increase the probability of lower biding in future.

August 20, 2018

7

Inox Wind | Quick Take

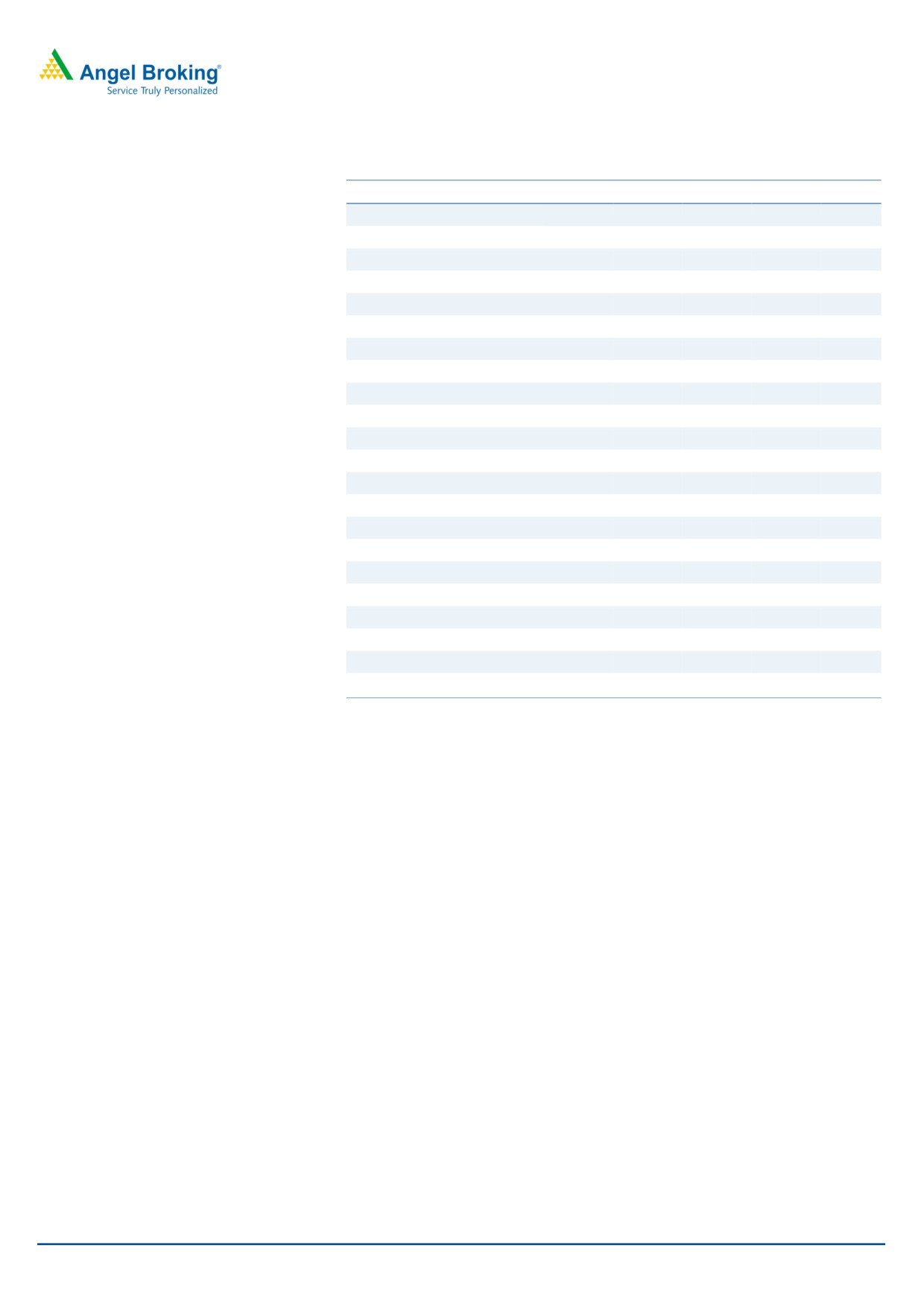

Income Statement

Y/E March (` cr)

FY16

FY17

FY18

FY19E

FY20E

Total operating income

4,451

3,415

480

3,360

3,971

% chg

65

(23)

(86)

600

18

Total Expenditure

3,737

2,855

561

2,881

3,364

Raw Material

2,716

1,920

47

1,983

2,303

Personnel

92

117

100

168

199

Selling and Administration Expenses

21

-19

-1

-9

-11

Others Expenses

908

836

416

739

874

EBITDA

713

560

-81

479

606

% chg

(22)

(21)

(115)

(689)

26

(% of Net Sales)

16.0%

16.4%

-17.0%

14.3%

15.3%

Depreciation& Amortisation

36

44

52

55

59

EBIT

677

517

-134

425

547

% chg

(25)

(24)

(126)

(418)

29

(% of Net Sales)

15

15

-28

13

14

Interest & other Charges

98

155

171

82

56

Other Income

70

65

24

27

29

Extraordinary Items

-

-

-

Recurring PBT

649

427

-280

369

520

% chg

(24)

(34)

(166)

(232)

41

Tax

188

124

-93

96

135

PAT (reported)

461

303

-188

273

385

% chg

(46)

(34)

(162)

(246)

41

(% of Net Sales)

10.4

8.9

-39.1

8.1

9.7

Basic & Fully Diluted EPS (Rs)

21

14

-8

12

17

% chg

(97)

(34)

(162)

(246)

41

Source: Company, Angel Research

August 20, 2018

8

Inox Wind | Quick Take

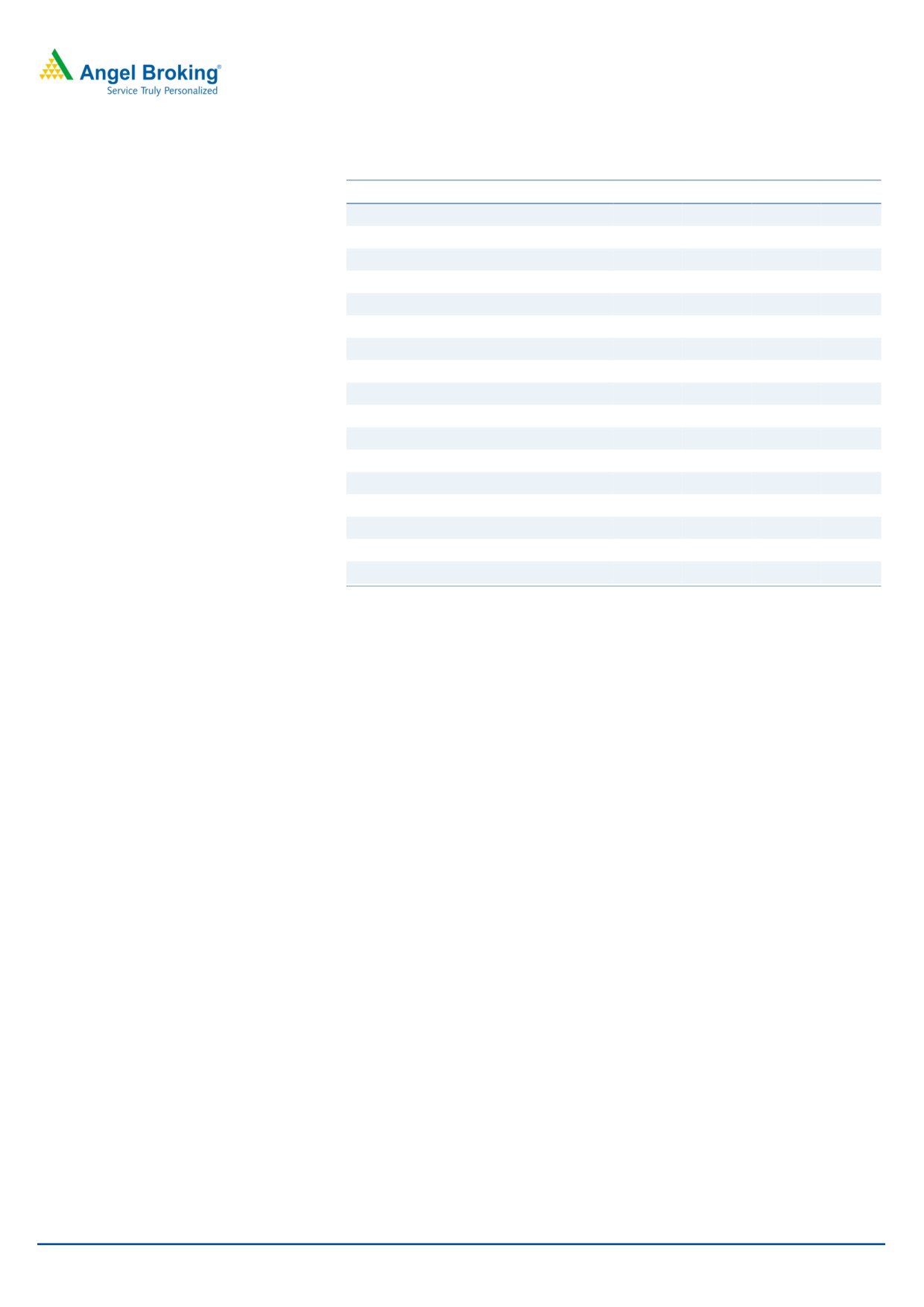

Balance sheet

Y/E March (`cr)

FY16

FY17

FY18

FY19E FY20E

SOURCES OF FUNDS

Equity Share Capital

221.9

221.9

221.9

221.9

221.9

Reserves& Surplus

1,665

1,968

1,782

2,056

2,441

Shareholders Funds

1,887

2,190

2,004

2,278

2,663

Total Loans

1,437

1,528

831

831

831

Other Liabilities

50

113

33

355

355

Total Liabilities

3374

3831

2868

3463

3848

APPLICATION OF FUNDS

Net Block

569

765

985

1,062

1,098

Capital Work-in-Progress

43

112

20

20

20

Investments

-

53

0

-

-

Long Term Loans & Advances

12

16

15

15

15

Current Assets

3,895

3,938

2,708

3,424

4,028

Inventories

560

690

929

690

816

Sundry Debtors

2,409

2,382

1,339

2,302

2,393

Cash

494

437

127

170

500

Loans & Advances

304

87

0

0

0

Investments & Others

128

341

313

262

318

Current liabilities

1,404

1,324

1,230

1,261

1,514

Net Current Assets

2,491

2,614

1,478

2,164

2,514

Other Non Current Asset

260

270

370

203

203

Total Assets

3374

3831

2868

3463

3848

Source: Company, Angel Research

August 20, 2018

9

Inox Wind | Quick Take

Cash flow

Y/E March (`cr)

FY16

FY17

FY18

FY19E FY20E

Profit before tax

649

427

(280)

369

520

Depreciation

36

44

52

55

59

Change in Working Capital

283

(436)

(669)

525

(215)

Interest / Dividend (Net)

98

155

171

82

56

Direct taxes paid

188

124

(93)

96

135

Others

(1,418)

(200)

1,088

(785)

129

Cash Flow from Operations

(163)

114

269

342

686

(Inc.)/ Dec. in Fixed Assets

(404)

(290)

(186)

(272)

(99)

(Inc.)/ Dec. in Investments

(31)

(111)

302

0

-

Cash Flow from Investing

(968)

(5)

332

(272)

(99)

Issue of Equity

-

-

-

-

-

Inc./(Dec.) in loans

1,403

90

-697

-

-

Others

(901)

(71)

(63)

55

(256)

Cash Flow from Financing

501

19

(760)

55

(256)

Inc./(Dec.) in Cash

(630)

128

(159)

124

331

Opening Cash balances

706

76

204

46

170

Closing Cash balances

76

204

46

170

500

Source: Company, Angel Research

August 20, 2018

10

Inox Wind | Quick Take

Valuation Ratios

Y/E March

FY16

FY17

FY18

FY19E FY20E

P/E (on FDEPS)

5

8

-12

8

6

P/CEPS

5

7

-17

7

5

P/BV

1

1

1

1

1

EV/Sales

1

1

5

1

1

EV/EBITDA

4

6

-32

6

4

EV / Total Assets

6

6

5

5

4

Per Share Data (`)

EPS (Basic)

21

14

-8

12

17

EPS (fully diluted)

21

14

-8

12

17

Cash EPS

22

16

-6

15

20

DPS

0

0

0

0

0

Book Value

85

99

90

103

120

Returns (%)

ROCE

20

14

-5

14

16

Angel ROIC (Pre-tax)

24

16

-5

13

16

ROE

24

14

-9

12

14

Turnover ratios (x)

Inventory / Sales (days)

46

74

707

75

75

Receivables (days)

198

255

1018

250

220

Payables (days)

97

104

408

110

110

Working capital cycle (ex-cash) (days)

146

225

1317

215

185

Source: Company, Angel Research

August 20, 2018

11

Inox Wind | Quick Take

Research Team Tel: 022 - 39357800

DISCLAIMER

DISCLAIMER:

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel

Broking Private Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014

vide registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or

co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material,

there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

Company Name

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or

No

relatives

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

August 20, 2018

12